ATED Return

What is an ATED Return?

ATED is a tax imposed by the UK government on companies that own high-value residential properties in the UK as a means of combating tax avoidance. The charges can be anywhere from £4.4k to over £287.5k depending on the value of the property.

You may need to complete an ATED return if…

- Own a UK residential property

- Property is owned through a company, a partnership in which one partner is a company, or a collective investment scheme.

- Or you have significant control over the property

- The property is over £500k

You may receive exemption or reliefs if (amongst others)…

-

- Charity or public body

- Hotel, guest houses and student accommodation

- The property was part-occupied

- Used for business or agricultural purposes

ATED can be complex, contact us if you’re unsure

The ATED return rules can be complex for a number of reasons:

- Over time the threshold has decreased and those who previously were not affected may be now.

- There are a number of exemptions and reliefs that you may be eligible for.

- If you fall in scope, but are exempt from paying, you still need to complete a filing. There are also fines for late payments.

Get in touch and we would be happy to explain if you are liable for ATED. If you are concerned you may have missed previous payments we can also help.

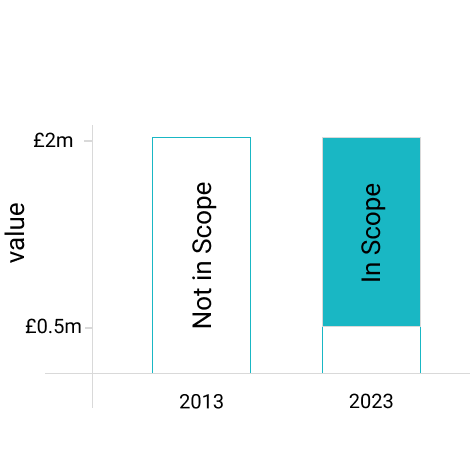

Is your property now affected?

Over time many more properties have fallen in scope. The original threshold (£2m) was reduced to £1m (from 2015). From 2016 it is £500k

Use our ATED tool

Use our ATED tool as a guide to how much you may owe for the 2025/2026 tax year…

Select the value of the property on 1 April 2022 (or if purchased after, the cost)

Your annual charge is estimated (£):

Again, the rules are complex and the final amount will vary depending on:

- If there are any reliefs available.

- You owned the dwelling for part of the year.

What happens if you don’t comply?

Non-compliance with the UK ATED filing requirements can result in substantial fines, so it is important to ensure compliance with the tax. Failure to file a return or pay the tax owed can result in fines, interest charges, and even criminal sanctions in severe cases. There are also fines for late filing and late payment.

Please note HMRC will also charge penalties for late and non-submission even when full relief and exemption applies to the tax.

Why Elemental?

How can Elemental help?

Elemental can help you determine if your company is required to pay ATED based on the value of your residential properties and your specific circumstances. Ways we can help clients:

- Eligibility – we can quickly help you to understand if you are subject to the ATED rules.

- Calculating ATED liabilities – We can assist you in assessing your ATED liabilities, ensuring that you are paying the correct amount of tax owed. We can also help with a pre-return banding check (PRBC) if your value is close to the thresholds.

- Filing ATED returns – We can help you file accurate and timely ATED returns, ensuring that the deadlines are met and HMRC penalties are avoided.

- ATED-related tax planning – We can give advice on tax planning strategies related to ATED e.g. stamp duty or capital gains, helping you to minimise your tax liabilities and avoid potential fines or penalties..

Request a proposal

If you have any questions on our Annual Tax on Enveloped Dwelling Service (ATED) please get in touch

and we would be happy to help.