February 18, 2025 ECCTA: Do I need to verify my identity?

The Economic Crime and Corporate Transparency Act 2023 (ECCTA) seeks to combat economic crime, improve corporate transparency, and improve the integrity of information at Companies House. A key initiative to support this drive is the new requirement for identity verification.

Companies House timings state that identity verification is planned from spring 2025. This article provides guidance on who will need to have their identity verified. Although the rules are not yet in force, organisations should start considering the implications.

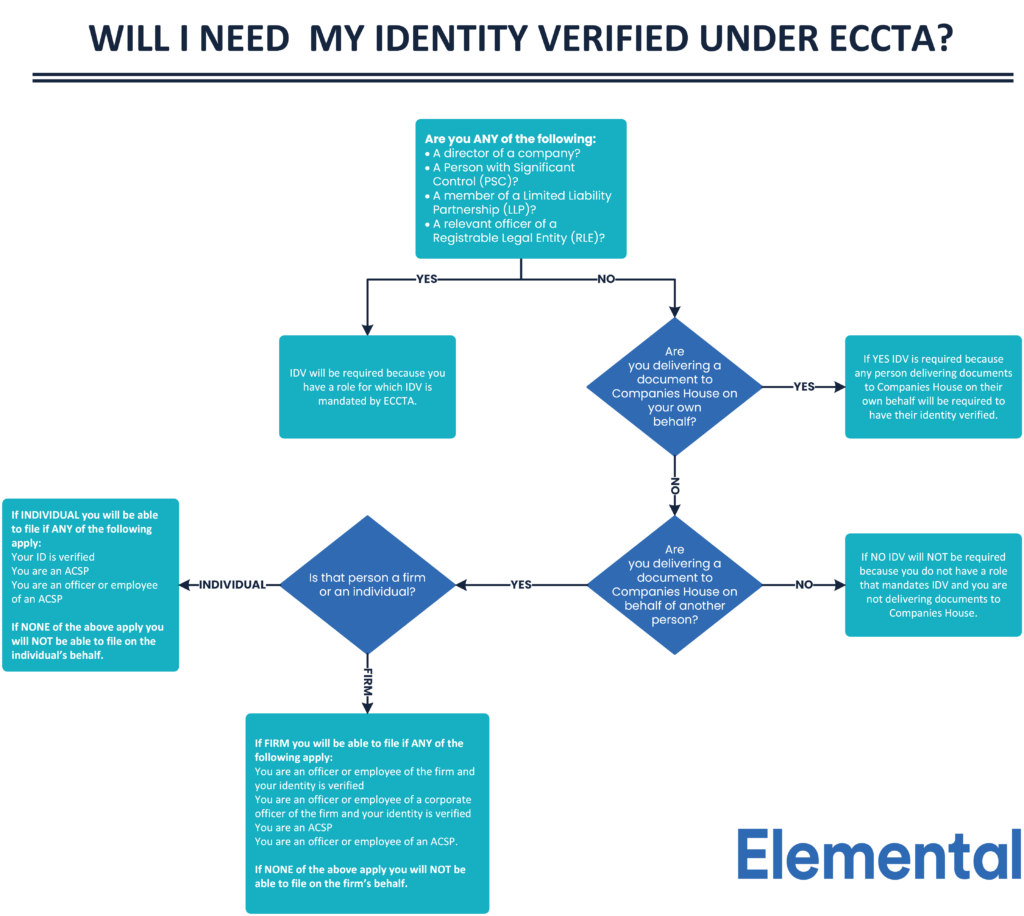

Do you need to verify?

Under the ECCTA, the following individuals are required to have their identity verified:

1. Directors

All new and existing directors of UK-registered companies must have their identities verified. This includes both executive and non-executive directors.

2. Persons with Significant Control (PSCs)

A PSC is someone who owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises significant influence over the company. New and existing PSCs must have their identities verified under the ECCTA.

3. Limited Liability Partnership (LLP) Members

For LLPs, the Act extends identity verification requirements to all members.

4. Managing Officers of Corporate General Partners of Limited Partnerships (LPs)

A general partner of a Limited Partnership that is a legal entity will need to ensure that it has a registered officer whose identity is verified.

A general partner that is a legal entity and that has one or more corporate managing officers will need to ensure that a named contact for each corporate managing officer is identified. This individual must be a managing officer of the corporate managing officer and must have their identity verified.

5. Corporate Entity Officers

In cases where a corporate entity itself serves as a director or PSC (RRLE) of another company, the officers of that corporate entity (i.e. directors) will also need to have their identity verified. This is to ensure transparency up the chain of ownership.

6. Authorised Corporate Service Provider (ACSP)

An ACSP is a third party that submits information to Companies House and can conduct identity verification. They are typically Trust and Company Service Providers, such as Elemental, or professional service providers such as law firms. They must be supervised by an AML supervisory body such as HMRC. A person who holds a senior role, such as an ACSP’s director will need to have their identity verified.

6. Those filing information on the register

When the new rules come in to force only ACSPs and those individuals that have had their identity verified will be able to file information on the register.

Practical considerations

Organisations should think carefully about their processes for ensuring the right people are verified as the new rules will present some challenges:

- An individual can only file with Companies House if their identity is verified. Organisations will want to think about who internally is verified and if there are contingencies in place for sickness or other absences.

- As the rules are currently written, organisations with group companies will need to consider who has sufficient authority to file for group entities. An employee for one subsidiary may currently be filing for other subsidiaries, but under the new rules, this is not automatically allowed.

- Sometimes PSCs and corporate officers of an organisation can be at arm’s length to the business, especially if they are overseas. Organisations should ensure they have up-to-date contact details and have made them aware of the verification requirements.

In total, Companies House estimates over 7 million individuals will need to have their identity verified. Verification will initially be voluntary with compulsory verification expected later in the year. ACSPs, such as Elemental, will be able to conduct ID verification and we are developing a bespoke solution designed to meet the needs of our clients. We will also be able to help firms overcome other challenges presented by the new rules.

______________________________________________________________________________________________________

**Elemental is now a registered Companies House authorised corporate services provider and is helping clients with Identity Verification Services**